|

|

| 04 jun 2022 |

17:34 |

|

The impact of Russias war on the potato industry of Ukraine Market

February 24, 2022 was a turning point for both Ukraine and the rest of the world, since the Russian invasion of Ukraine has undoubtedly turned the normal world order on its head.

|

|

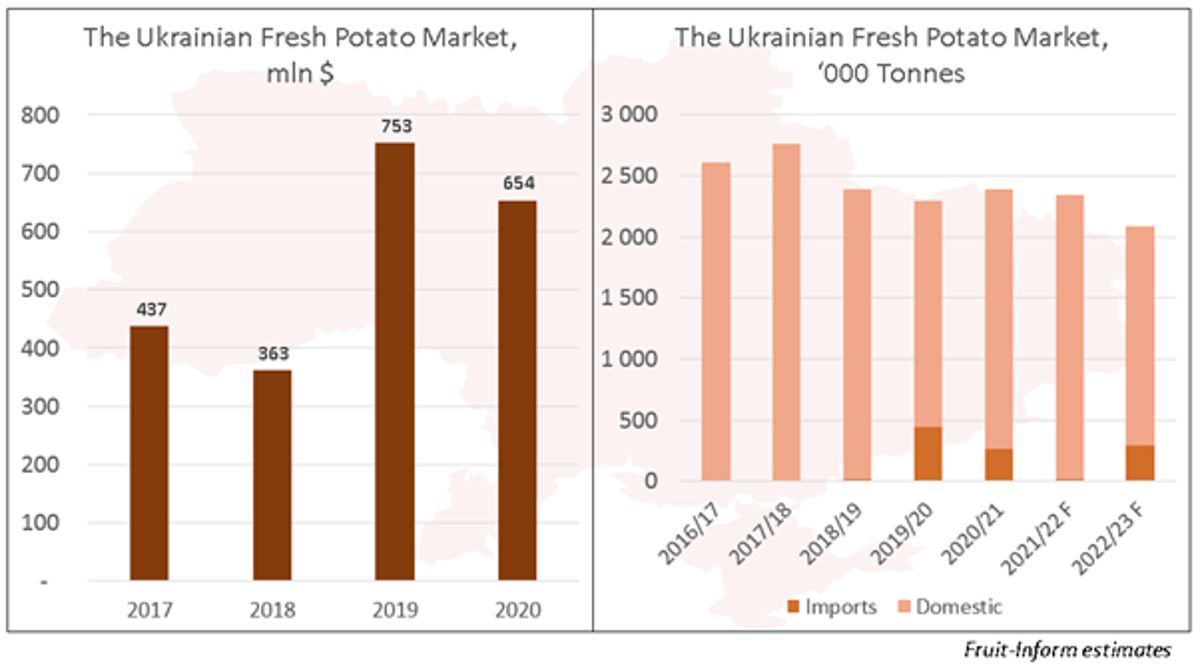

Ukraine and its citizens are suffering directly and indirectly in multiple ways because of the war. This is true for the Ukrainian economy of course, and it is also seriously impacting the country’s potato sector, annually valued at USD 400-800 millions just as far as the fresh market is concerned.

In 2020, Ukraine ranked as the third-biggest producer of potatoes in the world when the country produced 20,8 mln tonnes, according to figures released by the FAO. Despite this, the country’s domestic production is not enough to satisfy local market demand, and Ukraine is importing hundreds of thousands of tonnes annually.

(Click to enlarge)

Ukraine fresh potato market figures.

Potato producing regions impacted by the war

To date, several areas in Ukraine are either still occupied by Russian troops or adversely impacted by active fighting of the opposing militaries. Russian troops still occupy the Kherson Region and a significant part of the Zaporizhzhia Region in the south of the country, as well as Donetsk, Luhansk and Kharkiv Regions in the east.

Meanwhile, Ukraine’s recent counteroffensive forced Russian troops to withdraw from Zhytomyr, Kyiv, Chernihiv and Sumy Regions from the country’s north. However, despite their withdrawal, many farmers’ fields are still mined, and many potato warehouses have been destroyed by the Russian military.

The situation is especially critical in Chernihiv and Sumy Regions. These potato producing regions account for about 10% of the total area under potatoes in Ukraine, and many modern potato storage facilities are located there – some of which are also used by potato farmers from other regions of the country.

Meanwhile, full occupation of the Kherson Region is a terrible hit for the production of early potatoes this year, as it was always the main region in Ukraine for growing the earliest potato varieties.

Usually Kherson farmers prefer to ship their early potatoes to the larger cities in Ukraine (Kyiv, Dnipro, Kharkiv, Lviv) or for export to Belarus.

Shortage and rising prices of inputs

Russian troops’ recent strategy of missile strikes on fuel bases is a serious threat to normal operations of both the Ukrainian army and farmers, with the former being, of course, a priority.

Shortages mean higher prices, and despite the Ukrainian government’s decision to reduce taxes on fuel, farmers are still paying higher prices than before.

In addition, rising fuel prices also translate into higher transportation costs for all farm inputs, including fertilizer, plant protection products, seed, and several other inputs, which have already become more expensive worldwide due to the recent energy crisis and global logistics difficulties.

For Ukrainian potato farmers, shortages and the steep rise in inputs costs mean a decline both in acreage planted and expected potato yields, which will inevitably result in lower production and cause price rises of potatoes for Ukrainians, whose earnings also fell due to the war.

Loss of last year’s stocks and shortage of early produce

Occupation and active fighting in many regions of Ukraine have had an immediate effect on potato prices in the country, which have been rather low since the early beginning of the current season.

Firstly, several large potato warehouses in the northern part of Ukraine were simply destroyed or damaged, resulting in lower market supply of last year’s stocks.

Secondly, the destructive impact of the war on Ukrainian roadways resulted in price distortions in different Ukrainian regions.

As a result, potato prices now differ much from region to region. Immediately after the start of the Russian aggression, potato prices in Kyiv doubled from USD 0,17/kg to USD 0,34/kg, and current prices are at least 25-30% higher year-on-year in Ukraine.

Moreover, many stocks of seed potatoes are located in regions most impacted by the war, and farmers from other regions of Ukraine can simply not gain access to these stocks.

This is putting the total potato planting campaign for next season at serious risk, resulting in lower planted acreage and potentially lower yields.

Meanwhile, the full occupation of Kherson Oblast put the Ukrainian early potato season at significant risk.

Firstly, the supply of domestically grown early potatoes will be lower due to the occupation of the main producing areas.

Secondly, potato prices will be significantly higher starting from the very beginning of the marketing season due to expected supply shortages.

Thirdly, Kherson potato farmers will simply be put under the threat of bankruptcy due to their inability to access their traditional markets.

Changes in production structure and migration

Areas under potatoes and yields of commercial farmers will no doubt be lower in the new season due to rising costs and the destruction caused by the war.

However, total production volumes in Ukraine will be somewhat compensated by non-commercial farmers and backyard production.

A considerable part of potatoes in Ukraine is still grown by households themselves, and they usually tend to increase potato production in case of high prices and economic problems in the country.

Nevertheless, an increase in households’ areas will not be able to fully compensate Ukraine’s total production of potatoes in 2022. Based on our preliminary forecasts, total shortage of potatoes needed to fully satisfy the Ukrainian market could total about 290,000 tonnes in 2022/23.

This is a rather large volume, only surpassed in recent years during the 2018/19 marketing season, when total imports came to 445,000 tonnes.

This scenario is based on the assumption that the potential Ukrainian potato market size will be lower in 2022 due to the high migration from Ukraine.

Based on different estimates, slightly more than 5 million Ukrainian citizens have already left the country since the start of the war. If some Ukrainians decide to return home, a shortage of Ukrainian potatoes could become even more acute.

Ukraine is in need for support

Russia’s annual import of potatoes and potato products stand at about USD 200-400 millions, depending on the season, and the list of countries that ship potatoes (fresh or processed) to Russia is long and include such democratic countries as Poland, the Netherlands, Germany, Belgium and others.

For those who still work with Russia: each kilogram of potatoes shipped to the Russian market means the support for the Russian war in Ukraine, which includes atrocities as were uncovered when the tragedy in Bucha came to light.

|

|

|

|